Redfinger | An Overview of Emulators Status and Its Development Trend 2022

Due to the global popularity of mobile internet, the number of gamers in overseas markets is hiking year by year. As per a report, the overseas market exceeds 2 billion bark in 2020. With more and more Chinese game makers going abroad, the revenue of the Chinese game overseas market is also steadily increasing.

Due to the global popularity of mobile internet, the number of gamers in overseas markets is hiking year by year. As per a report, the overseas market exceeds 2 billion bark in 2020. With more and more Chinese game makers going abroad, the revenue of the Chinese game overseas market is also steadily increasing.

The report released by Sensor Tower notes that the Chinese games market led by Genshin Impact is a leading player, reaching $406.3 million (approximately RMB 2.579 billion) and accounting for half of the total revenue of the other categories, according to revenue of different types of mobile games in the United States in 2021,

Following the previous promotions of the Blue Archives and Arknights, players invest a lot in these games. In addition to the revenue, game publishers enable players across the world to get to grasp an understanding of China's culture. Take Yostar as an example, almost every game is tied to an emulator, indicating emulators play an essential part in a channel for games to go overseas.

Emulators' Stable Growth in Traffic and Revenue

It can be divided into two main parts in terms of the distribution of countries using the emulators. One part is the large traffic market consisting of Latin American and South East Asian countries represented by Brazil, India, and Vietnam; the other is the T1 market with high net worth income represented by the USA, South Korea, Japan, Taiwan, China, and Mainland China.

Represented by Latin America and South East Asia, the traffic market boasts great potential to gain profits. The high-income T1 market, represented by China, Japan, Korea, and the US, is now a fierce part of emulators.

High-revenue T1 Market Characteristics

As mentioned above, the T1 market for mobile game emulators covers the United States, South Korea, Japan, Taiwan, China, and Mainland China, sitting at nearly 90% of the revenue share in the sector.

Device Penetration

As the highest PC penetration rate in the world with more than 90, the United States leaves room for advancement in the emulator industry. Besides, a large number of highly loyal end games can be found in Japan and South Korea. All these factors combined lay a foundation for the development of emulators.

Willingness to Pay in Games

For instance, in mainland China where the gaming industry has been booming in recent years, the willingness of users to pay is gradually increasing. Among them, emulator users who are characterized by high net worth and affordable perform best in payment. Therefore, there is no need to worry about the price in the T1 markets, covering the US, Japan, and Korea.

Game Categories

According to App Annie's Mobile Market Report 2022, the top 3 highest-grossing game categories worldwide in 2021 are strategic, role-playing, and card-typed games. As a matter of fact, these high-grossing games in the T1 markets gain popularity. As such, the T1 markets boast strong revenue momentum.

Increasingly Competition Scenarios in T1 Markets

As mentioned earlier in the report, it is self-evident that the T1 market plays an essential part in developing mobile game emulators. At present, five of the six major emulators in the world come from China, including Nox Player, LDPlayer, MuMu Player, GameLoop, and Memu Play, and the other one is Bluestacks from the US.

Since the majority of mobile game emulators are from China, the nation has naturally become the main landscape for all emulators, thereby allowing the competition to become fiercer. Along with the globalization of the industry as a whole, the competition has gradually turned to the T1 market since the year of 2015.

Mobile Games Emulators Development Trend

Game Publishers Develop PC Clients

With the increasing demand for PC scenarios for mobile gamers, game publishers have paid attention to user acquisition through mobile game emulator channels since 2015. As a result, major players invest a certain amount of money each year to acquire high-net-worth users from the top mobile game emulators.

However, from late 2020 to 2021, Japanese and Korean game publishers led by NCSoft gradually develop PC clients and even develop their own emulators. Some of them choose to block emulators to ensure that users employ their own PC versions.

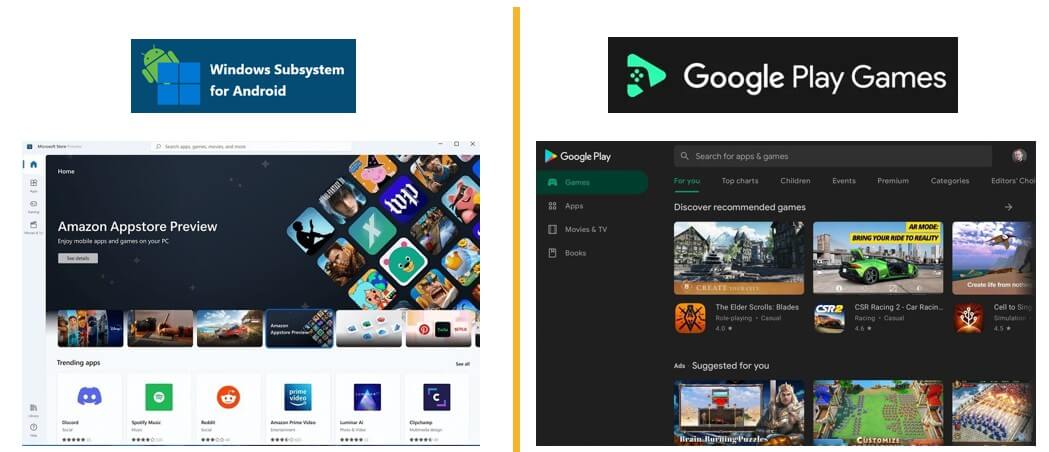

Microsoft and Google Participate in Emulators Development

Both major game publishers and Microsoft and Google gain attention to the market potential. The Android subsystem in Windows 11 can run Android apps directly on desktops, while Google's Google Play Games PC to be launched in 2022 can run Android games on computers as well.

Updated Users Requirements to Boast Sound Experience

With Microsoft and Google announcing their support in 2021, the competition landscape become fiercer. On the one hand, Microsoft and Google can undoubtedly be able to allow a certain number of users to use their own products. On the other hand, users who play mobile games on PC clients need the corresponding functions of emulators, such as keyboard control, multi accounts opening, and script recording. In this regard, Microsoft and Google are currently unable to meet users' demands.

In other words, Microsoft and Google, and even game publishers, cannot shake the position of mobile users on emulators. However, if sparing no efforts to bridge the gap with their leading-edge technology, the competition will turn to user experience ultimately.

Metaverse Shown in Gaming Sector

As is known to all, Facebook previously announced that it will transform into a metaverse firm within 5 years. ByteDance has also acquired VR hardware makers for more than 9 billion RMB to get on the metaverse track. As the first stock in the metaverse, Roblox went public in March 2021 and its share price hiked 50% on the first day.

Both game developers (Epic Games) and hardware manufacturers (Nvidia) are gradually laying out their metaverse. In this sense, mobile game emulators as a vehicle for games are likely to grasp this trend.

Cloud Gaming Revolution

The limitation of terminal hardware has remained hard for the current mobile gaming industry for a long time, and it will even exert an impact on the future market. However, cloud gaming can break through the limitation and enable users to boast a sound experience by enhancing the computing power and data transmission capability of cloud servers.

At present, cloud gaming is mainly limited as to the high cost of servers. But it should be noted that cloud gaming may become an important trend for developing the whole gaming industry in the future, and fit better with users who want to use their spare time to enjoy playing games and leveling up characters in a quick manner.

In Conclusion

With the development of technology in recent years, games gradually put emphasis on cross-platform gameplay, proving that there is a growing need for major players in the sector to become top-notch. Cross-platform gameplay is more likely to become mainstream, posting a challenge for mobile game emulators.